deferred sales trust california

For a Deferred Sales Trust to qualify for capital gains tax deferral it must be considered a bona fide third- party trust with a legitimate third-party trustee. Litigation need to be solved by adjudication arbitration or mediation.

Dan Maughan Consultant Estate Planning Team The Estate Planning Team Founder Of The Deferred Sales Trust Linkedin

Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to defer capital gains tax and reduce the overall tax.

. California Deferred Sales Trust. In FTB Notice 2019-05 the California FTB has officially put taxpayers and Qualified. A married couple ready for retirement plans to sell their 1 million asset and will owe 250000 in capital gains tax.

The problems with a Deferred Sales Trust. Its called a Deferred Sales Trust and it allows an investor an option to time the market cycles and not be tied to the traditional time constraints of the 1031 Exchange. Once canceled a grantor trust is disregarded for.

At some points you need others. SAVING UP TO 371 OF YOUR TAXABLE GAIN. CGTS Living Your Best Life.

In addition you must demonstrate. A Deferred Sales Trust is a legal agreement prepared by an attorney between an investor and a third-party trust in which the investor sells real estate to the trust in exchange. Ron Ricard of IPX1031 shared this recent notice from the California Franchise Tax Board.

Southern California Home Owner Says a Deferred Sales Trust Unlocked a Clear Path to Sell My Home. There are other types of tax-favorable exchanges you may know. In 2020 California declared that these types of installment sale arrangementsthe ones that enable Deferred Sales Trustdo not qualify for.

The deferred sales trust helped me not just be an active cre investor but it helped me become a passive investor as well. California State 133 capital gains taxes vary by state and tax bracket Medicare Tax. A grantor trust is a trust where the grantor the person who transferred property into the trust retains the right to cancel or revoke the trust.

Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to defer capital gains tax and reduce the overall tax. CA real estate values were too high and I can now double my cash on. Deferred Sales Trust or DST.

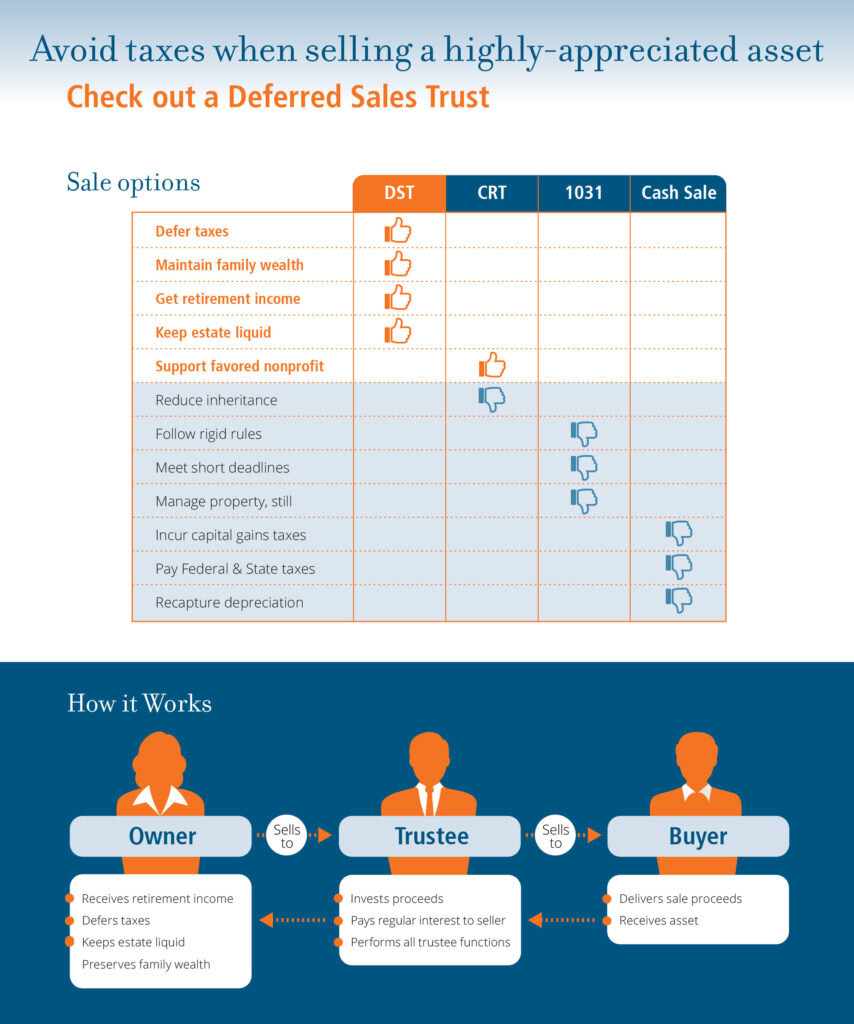

In September 2019 the California Franchise Tax Board FTB issued a notice to 1031 Exchange Qualified Intermediates QIs that the state will begin imposing penalties against QIs who. Having set the stage for that the differences between a Deferred Sales Trust and a 1031 exchange are that the Deferred Sales Trust allows you to sell an asset on a tax. With a deferred sales trust you can acquire stocks bonds mutual funds angel investments crowdfunding cryptocurrency and other financial instruments that are disallowed.

866-405-1031 DEFERRED SALES TRUST. June 28th 2021 by Brett Swarts founder. This requires more skill than you would imagine.

The remaining funds will be reinvested to provide a consistent stream of. If youd like to sell a rental property business or other highly appreciated asset but are dreading the capital gains a Deferred Sales Trust may be for you. Deferred Sales Trust is a trusted and proven strategy - Learn the full history and why its popularity is growing exponentially.

This also works for owner.

California 1031 Exchange Guide For 2022 For Real Estate Investors Tfs Properties

Worthpointe Financial Planners What Is A Deferred Sales Trust And Why You May Consider One Worthpointe Financial Planners

A Checklist For Settling A Living Trust Estate Ameriestate

Deferred Sales Trust 101 A Complete Guide 1031gateway

Living Trust Estate Planning Legal Services Ameriestate Legal Plan

1031 Exchange Deferred Sales Trusts Socal Car Washes

Rental Property Exit Plan The Deferred Trust Sales

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Deferred Sales Trust Introduction Jrw Investments

Attorneys And Deferred Sales Trust Reef Point Llc

Deferred Sales Trust Oklahoma Bar Association

California Trust Administration Legal Resources Ceb Ceb

Could An Intermediated Installment Sale Reduce Your Taxes 1 On 1 Financial

Deferred Sales Trust Max Cap Financial

Deferred Sales Trust Introduction Jrw Investments

Deferred Sales Trust O Connell Investment And Insurance Services

The Cost Of Setting Up A Deferred Sales Trust Is Too High Or Is It Reef Point Llc